Yield farming always felt like chasing a wild stallion to me—exciting, but unpredictable. Seriously, one minute you’re watching your crypto grow, the next you’re wondering if you just got rekt. Something felt off about how most wallets handled the whole experience, especially when juggling multiple chains. I mean, if you’re diving deep into DeFi, you want tools that actually protect your gains, not eat them up in sneaky fees or front-running attacks.

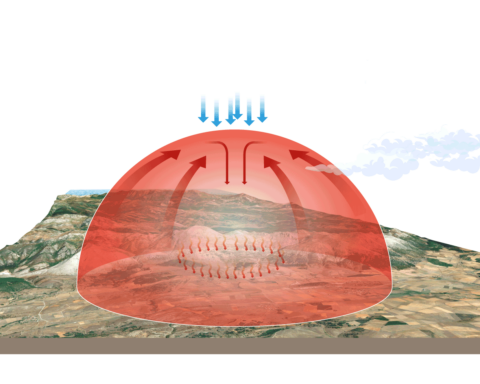

Initially, I thought yield farming was all about stacking rewards across various protocols and chains. But then I realized it’s so much more—tracking your portfolio and defending against MEV (Miner Extractable Value) plays a huge role. MEV protection might sound like tech jargon, but it’s a real threat when bots and miners manipulate transaction orders to skim profits. It’s like trying to get a fair deal at a market where the clerk knows exactly how to shortchange you.

Okay, here’s the thing. Most wallets out there can handle simple transactions, but when you’re hopping across Ethereum, BSC, Polygon, and others, things get messy fast. I’ve lost track of how many times I wished for a wallet that not only tracks my multi-chain yield farming positions but also shields me from MEV exploits. That’s where rabby wallet comes in.

Whoa! Did you know rabby wallet integrates advanced portfolio tracking with built-in MEV protection? It’s kinda rare to see that combo. This wallet offers a seamless multi-chain experience, letting you monitor all your yield farming activities in one place without constantly switching apps or guessing your real returns. And yeah, it’s not perfect, but honestly, it’s a step up from juggling five different dashboards.

Hmm… I remember the first time I realized MEV was costing me more than gas fees. My instinct said, “Wait, something’s draining my gains, but it’s not obvious.” Turns out, bots were sandwiching my transactions, turning my profit into their payday. On one hand, I thought avoiding DeFi’s complexity was the answer, though actually, that just meant missing out on juicy yields. So, learning to use tools like rabby wallet changed the game for me.

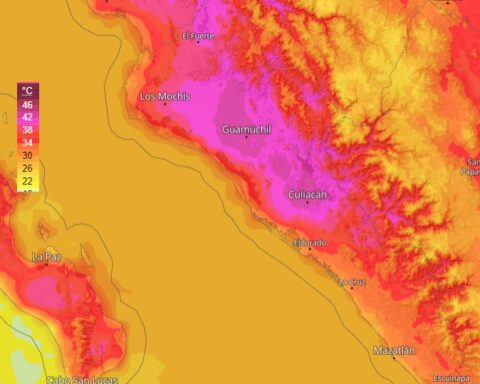

Tracking your portfolio across chains isn’t just about numbers. It’s about understanding where your risks lie. Like, if you’re farming on Polygon but holding assets on Ethereum, a sudden price swing or network congestion can ripple through your positions unexpectedly. Rabby wallet’s real-time updates and alerts help cut through that noise, giving you a clearer picture of your overall exposure.

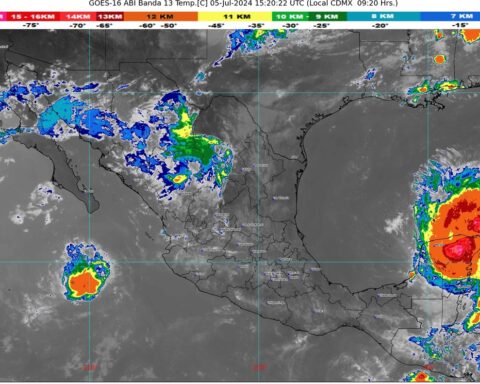

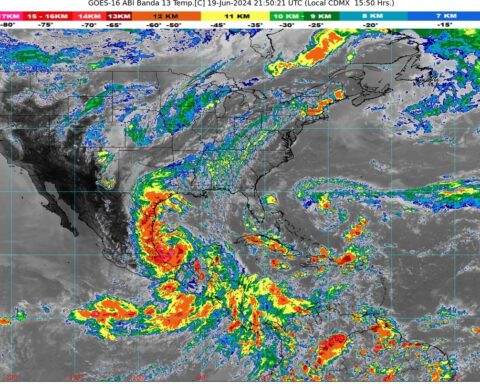

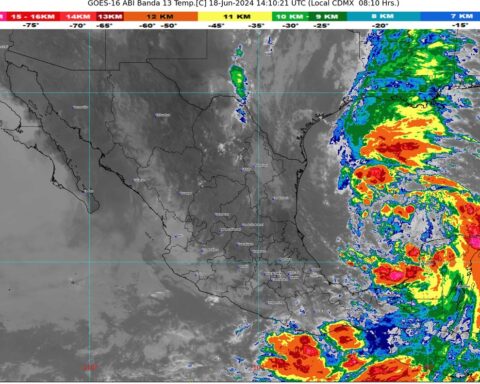

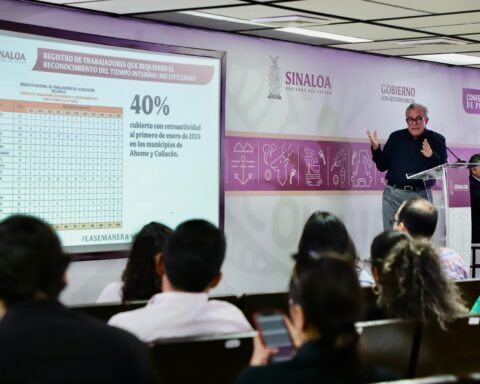

Check this out—

That dashboard makes it easier to spot opportunities or red flags without digging through countless DeFi platforms. Trust me, having that bird’s eye view is worth its weight in ETH. Plus, the wallet’s MEV protection layers act like a shield, preventing those sneaky transaction reorderings that can cost you dearly, especially when farming volatile tokens.

Here’s what bugs me about most DeFi setups: they treat security and convenience like separate things. You either get a wallet that’s secure but clunky or one that’s slick but exposes you to subtle risks. Rabby wallet seems to bridge that gap, giving both advanced security features and a user-friendly interface that doesn’t require you to be a crypto dev.

One personal note—I’m biased, but I prefer wallets that offer open-source transparency. Rabby wallet’s codebase and community-driven updates make me feel like I’m not just trusting some black box. It’s like having a buddy who’s a hacker vet checking your back on every transaction. That peace of mind is priceless when you’re dealing with serious yield farming strategies.

Now, I’m not 100% sure about how every MEV attack is blocked, since the landscape constantly evolves. But rabby wallet’s approach—combining transaction batching, slippage protection, and gas fee optimization—reduces your attack surface significantly. It’s not foolproof, but it’s better than flying blind or relying on manual tweaks.

Yield farming is a bit like surfing—a mix of timing, skill, and luck. Without proper tools, you’re just hoping to catch the right wave. But with smart portfolio tracking and MEV protection, you get to read the tides better, minimizing wipeouts. And since many DeFi users now spread assets across dozens of protocols and chains, having a wallet that understands this complexity is very very important.

Why Multi-Chain Support Is No Longer Optional

Remember when crypto was mostly Ethereum? Yeah, that was simpler. Today, the DeFi ecosystem is a sprawling web of chains, each with unique yield opportunities and pitfalls. My gut told me long ago that to stay competitive, I needed a wallet that didn’t lock me into one ecosystem. Rabby wallet’s multi-chain support means you can farm on Avalanche, track on Fantom, and still manage assets on Ethereum—all within one interface.

But here’s a subtle challenge: multi-chain wallets can sometimes sacrifice speed or security for convenience. Actually, wait—let me rephrase that. They often have to carefully balance those factors, which is why many users face trade-offs. Rabby wallet’s design tries to keep that balance by integrating MEV protection layers per chain, not just lumping everything together. This granular approach helps avoid the “one size fits all” pitfalls.

Honestly, the crypto space could use more wallets like this. Because without comprehensive portfolio tracking, you’re basically flying blind, risking overexposure or missing timely harvests. And without MEV protection, you’re vulnerable to a hidden tax that eats your profits quietly. It’s like paying a toll on a highway you didn’t even know existed.

And oh—by the way, the user experience on rabby wallet is smooth enough that even folks not super deep into DeFi can jump in without feeling overwhelmed. That’s a big deal. The last thing you want is a wallet that requires a PhD to understand, especially when timing your yield harvests can mean the difference between profit and loss.

So, if you’re serious about yield farming and want to keep your portfolio healthy across chains without losing sleep over MEV bots, exploring wallets like rabby wallet is worth your time. They’re not perfect, but they represent a new class of DeFi tools that actually get the user’s pain points.

In a nutshell, the DeFi world is maturing. As it does, the tools we use have to evolve—offering smarter portfolio tracking, stronger MEV defenses, and seamless multi-chain experiences. Rabby wallet is one of those tools. If you haven’t checked it out yet, it might just save you some headaches and, more importantly, some crypto.