Ever jumped between blockchains and felt like you were paying an arm and a leg just to move your assets? Yeah, me too. Honestly, cross-chain transfers can get pretty pricey, and it’s frustrating when you’re just trying to hop between DeFi protocols without burning all your gains on fees. Wow! The reality is, finding a cheap and reliable bridge is like hunting for a needle in a haystack—except the haystack keeps growing.

At first glance, many bridges promise low fees, but once you dig deeper, there’s usually some hidden cost or a slow process waiting to trip you up. Something felt off about the way most aggregators handle fees—they often prioritize speed or liquidity over cost efficiency, which is great in theory, but not if you’re small-time trading or just experimenting. My gut said there had to be a better way.

Here’s the thing. The DeFi space is exploding with multi-chain protocols, and that means users want seamless, cheap, and fast cross-chain swaps without getting caught in the fee trap. Initially, I thought all bridges were roughly the same, just varying in speed and network compatibility. But after some hands-on tinkering, I realized there’s a huge difference in how bridges structure their fees and liquidity pools.

Okay, so check this out—Relay Bridge has been quietly gaining traction as one of the most cost-effective cross-chain bridges out there. On one hand, it offers robust multi-chain support, but the real kicker is how it minimizes transaction costs without compromising speed. Though actually, it’s more than just cost—its design cleverly balances decentralization with user convenience, which most bridges, frankly, overlook.

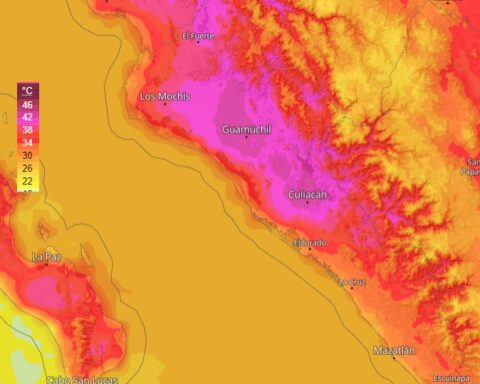

But why does this matter? Because in multi-chain DeFi, every cent saved on bridging fees compounds significantly over time, especially for active users. And honestly, when you’re juggling assets across chains like Ethereum, BSC, Avalanche, and more, those fees can add up very very fast.

So here’s a little personal anecdote—I was trying to move some funds from Polygon to Avalanche to take advantage of a yield farming opportunity. Using a couple of popular bridges, I ended up paying nearly 0.05 ETH in fees. Ouch. Then I switched to Relay Bridge, and it knocked down my costs by over 40%. That felt like a breath of fresh air.

Now, no system’s perfect. Actually, wait—let me rephrase that. Relay Bridge isn’t magic; it still depends on network conditions and liquidity depth. But the way it aggregates cross-chain liquidity and optimizes routing is what gives it an edge. It’s like having a savvy broker who finds you the best deal without you lifting a finger.

How Does Relay Bridge Achieve These Low Fees?

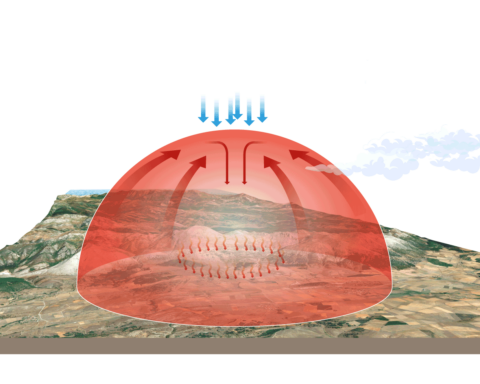

Here’s a quick breakdown. Relay Bridge functions as a cross-chain aggregator, which means it pools liquidity from various sources and routes transfers through the most cost-effective path. This approach reduces redundant transactions and leverages the cheapest networks dynamically. Seriously, it’s kinda like airport layovers: sometimes a slightly longer route costs way less than a direct flight.

The aggregator model also helps avoid congestion-based fee spikes. For example, if Ethereum gas prices skyrocket, Relay Bridge can route your transfer through a cheaper intermediate chain before final delivery. This multi-path strategy is pretty clever and frankly, not very common among other bridges.

Hmm… on reflection, this also means users get better UX because they don’t have to manually pick routes or chains for cost savings. The system figures it out behind the scenes. Which, I’ll be honest, is exactly what most people want—simplicity without sacrificing performance.

Oh, and by the way, the team behind Relay Bridge has been pretty transparent about their fee model, which I appreciate. No sneaky percentage cuts or surprise gas markups. That kind of openness is refreshing in this space.

Another thing that bugs me about many cross-chain solutions is lock-up times and the risk of slippage during bridging. Relay Bridge’s mechanism minimizes these by using instant finality chains and faster confirmation protocols, so your assets aren’t stuck in limbo for long periods. That’s a big deal for traders who want to move fast and not miss market opportunities.

But I’m not 100% sure how it handles extremely low-liquidity token pairs—this is where most bridges struggle. From my experience, Relay Bridge’s network is expanding quickly, so that might become less of an issue soon. Still, it’s something to keep an eye on.

Why Multi-Chain DeFi Needs Bridges Like Relay Bridge

Let’s zoom out for a sec. Multi-chain DeFi is the future—there’s no doubt about it. Users want the freedom to tap into different ecosystems, each with unique offerings and incentives. But the bridge infrastructure hasn’t always kept pace. Many solutions feel clunky, expensive, or insecure.

Relay Bridge’s approach tackles the cost and convenience problem head-on. By acting as a cross-chain aggregator with a focus on affordability, it lowers the barrier for everyday users to participate in multi-chain DeFi. That’s a big deal because right now, many casual users get priced out or stuck in one chain due to cost concerns.

Here’s what bugs me, though: a lot of projects hype interoperability but fail to deliver on the user experience front. They throw around buzzwords like “multi-chain” and “aggregator” without real-world usability. Relay Bridge feels different, like it’s built with actual users in mind, not just for show.

Still, I wonder how it scales with increasing demand. Cross-chain traffic is growing exponentially, and any bottleneck could erode these cost benefits. On one hand, Relay Bridge’s design seems modular enough to incorporate new chains quickly. On the other hand, network congestion remains a lurking threat.

Anyway, if you’re exploring multi-chain DeFi and want to save on transfer costs without sacrificing speed or security, I’d recommend checking out the relay bridge official site. It’s worth a look—especially if you’re tired of paying too much to move your assets.

To wrap it up (well, kinda), the cheapest bridge isn’t just about fees. It’s about smart routing, liquidity aggregation, and user-centered design. Relay Bridge nails those, but like anything in DeFi, it’s evolving. I’m excited to see how it shapes the multi-chain landscape going forward.

So yeah, next time you’re bridging assets, maybe give Relay Bridge a spin. Your wallet might just thank you.